Facts About Lighthouse Wealth Management Revealed

Wiki Article

8 Easy Facts About Retirement Planning Canada Described

Table of ContentsEverything about Retirement Planning CanadaWhat Does Retirement Planning Canada Mean?10 Easy Facts About Investment Representative ExplainedSome Known Incorrect Statements About Private Wealth Management Canada The Ultimate Guide To Retirement Planning CanadaExamine This Report on Private Wealth Management Canada

“If you were to get an item, say a television or a pc, you might wish to know the requirements of itwhat are its parts and just what it can create,” Purda explains. “You can consider buying monetary guidance and help in the same way. People must know what they're getting.” With financial guidance, it's important to keep in mind that the product is not ties, stocks or any other opportunities.It’s things such as budgeting, planning retirement or paying off personal debt. And like buying a pc from a trusted organization, customers want to know they're purchasing financial information from a trusted expert. Certainly one of Purda and Ashworth’s most interesting results is around the costs that monetary planners cost their customers.

This held genuine no matter the cost structurehourly, fee, possessions under management or flat rate (when you look at the study, the dollar property value fees ended up being the same in each instance). “It nevertheless comes down to the value proposal and doubt on the consumers’ part they don’t know very well what these are generally getting back in trade for those charges,” claims Purda.

Investment Representative Things To Know Before You Get This

Pay attention to this information once you notice the word economic expert, just what comes to mind? Many people remember an expert who are able to give them economic guidance, specially when it comes to spending. That’s an excellent place to start, but it doesn’t paint the entire picture. Not even close! Financial analysts can help people with a number of other cash targets also.

A monetary expert assists you to build wealth and shield it for the long lasting. They're able to calculate your personal future monetary needs and plan ways to extend your your retirement savings. They can in addition counsel you on when you should start tapping into personal Security and utilizing the amount of money in your pension accounts so you're able to prevent any nasty charges.

Examine This Report on Private Wealth Management Canada

They could allow you to find out what shared funds are best for your needs and show you simple tips to handle and make the absolute most of your own investments. They may be able additionally allow you to understand the dangers and just what you’ll should do to reach your aims. An experienced financial investment professional will also help you stay on the roller coaster of investingeven as soon as opportunities just take a dive.

They could supply you with the guidance you ought to develop plans to ensure that your wishes are performed. And also you can’t put an amount label on peace of mind that accompanies that. According to research conducted recently, the typical 65-year-old pair in 2022 should have around $315,000 saved to cover healthcare expenses in pension.

The Best Strategy To Use For Ia Wealth Management

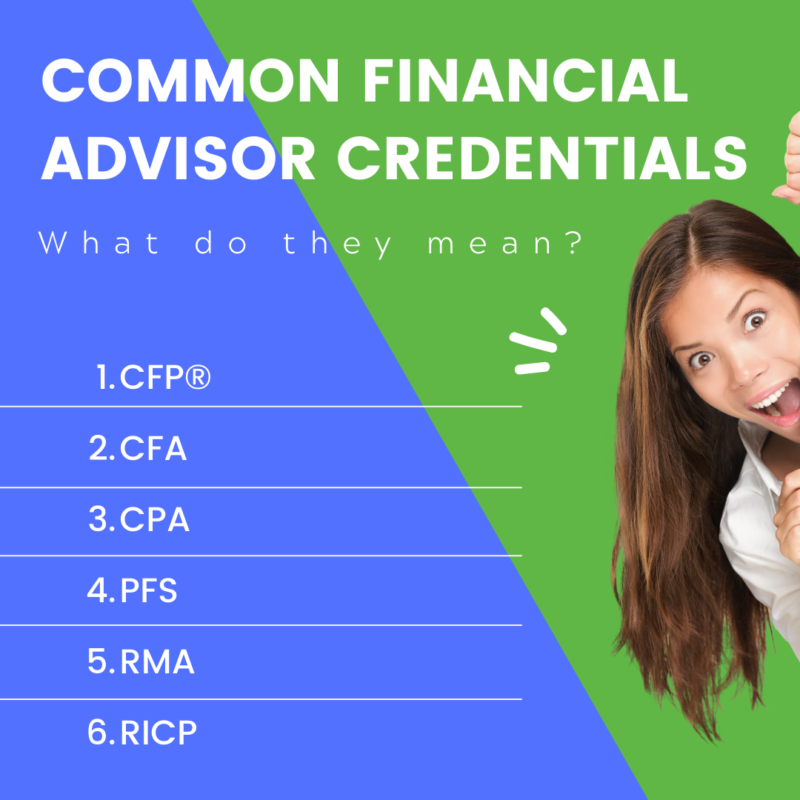

Now that we’ve gone over exactly what economic experts would, let’s dig into the many types. Here’s good guideline: All economic planners are monetary analysts, but not all advisors tend to be coordinators - https://nowewyrazy.uw.edu.pl/profil/lighthousewm. A monetary coordinator centers around helping men and women create plans to achieve lasting goalsthings like beginning a college investment or keeping for a down payment on a home

Exactly how do you understand which economic advisor suits you - https://www.indiegogo.com/individuals/36672649? Here are some actions you can take to be certain you are really employing ideal individual. Where do you turn once you have two bad options to pick? Effortless! Discover more solutions. The more solutions you really have, a lot more likely you may be to make a great choice

More About Investment Representative

All of our Intelligent, Vestor system can make it easy for you by showing you around five economic analysts who is going to serve you. The good thing is, it is totally free to obtain regarding an advisor! And don’t forget to come quickly to the meeting prepared with a list of questions to ask to find out if they’re a good fit.But listen, simply because a consultant is smarter compared to ordinary bear does not let them have the ability to show what to do. Sometimes, analysts are loaded with themselves because they have more degrees than a thermometer. If an advisor starts talking down to you, it’s time to demonstrate to them the doorway.

Remember that! It’s essential that you as well as your financial specialist (anyone who it eventually ends up being) take exactly the same page. You need a consultant who's a lasting investing strategysomeone who’ll convince one hold investing constantly if the marketplace is up or down. private wealth management canada. In addition, you don’t would you like to utilize a person that forces one purchase a thing that’s too dangerous or you’re not comfortable with

Excitement About Independent Investment Advisor Canada

That blend provides you with the diversification you'll want to successfully spend when it comes to longterm. Whilst research financial experts, you’ll most likely come across the term fiduciary task. This all indicates is any specialist you hire has to work such that benefits their particular client rather than their own self-interest.Report this wiki page